Balancing your checkbook for the modern person.

If you are searching for a way to balance your checkbook, but don’t actually write checks or have a book that you keep your balances in, then you’ve come to the right place. In today’s world, the checkbook is obsolete. If you do any research or listen to your parents, you’re supposed to write down every dollar you spend in this little book and carry the total, but seriously, do you know anyone that actually does that?

My goal is to give you a viable method for keeping track of your bank balance and possibly even save you hundreds of dollars in bank fees.

The first step is realizing that you’re wasting your money with all of those overdraft bank fees and that you really should be spending some time keeping track of that balance.

Step two is finding out what your current bank balance is. I’m certain you know how to do this since the modern day young adult calls their bank or goes online to see how much they can spend tonight; so do that and write the number down.

Now, here’s the trick that’s probably gotten you in trouble every time: What’s not represented in that number! Right?!

So let’s take a couple steps back and set up a system that will assure your success in knowing your checking account balance.

Keeping some sort of record of every penny you spend is imperative. To start, I recommend getting a folder or envelope to keep all of your receipts in, then, make sure you get a receipt every time you use your debit card, no excuses now. If the paper runs out at the gas station, take the time to go inside and get the receipt or at least write it down clearly on a spare piece of paper. Now, put that receipt in a special place every time. Have a small envelope in your purse, put it in the same spot in your wallet, or at least jam it in the same pocket and at the end of the day, take out your stack and put it in the aforementioned folder or envelope. You will never be able to keep up with your account balance if you don’t keep records, so start your habits now. When you spend money online, print out your receipt and

put it in that folder. Every utility payment, insurance bill, credit card bill payment, etc needs to be printed out and put in that folder so you don’t forget about it. As you become more proficient with balancing your account, you can set up a folder in your email program and drag all your receipts there, but don’t skip the step of printing them

out until you have your finances under control.

Now, write down all of your automatic deductions on a big piece of paper. Record the date the funds will be deducted from your account, the company and the amount. This is what catches most people off guard, so make sure you get the gym membership, cable bill, life insurance, car insurance or whatever else that comes out of your account automatically. Make sure this is a full piece of paper, because this information may change frequently, and you’ll need to keep it updated.

Now it’s time to get to work. If you happen to know where that old (unused) check register is that they gave you when you opened the account, feel free to use it, or you can just get out a piece of paper and write down these headings: Date, Description, Deposit, Deduction, Clr and Balance as follows:

| Date | Description | Deposit | Deduction | Clr | Balance |

|---|---|---|---|---|---|

| Beginning Balance | $ 250.00 | ||||

If you would like to be a tad more modern, you can create this template in Microsoft Excel or download a template here . If you’re really technically savvy, you can use a template on Google Drive and update your balance from anywhere, including your phone. Click here for a sample template.

Payday is a great day to start this, but any day will do. Call the bank (or get Online) and get your balance. Let’s say your balance is two hundred fifty dollars ($250.00), write that on the first line of the template you used. Now, write down the transactions that you know have not cleared your account: The check you wrote to your roommate, the coffee from the small local café, etc. Now write down any automatic deductions that will hit your account between now and the next time you get paid. Use the list you made earlier to insure you don’t miss anything. Carry your balance down and you have a pretty good idea of how much money is in your account. Your template may look like this:

| Date | Description | Deposit | Deduction | Clr | Balance |

|---|---|---|---|---|---|

| Beginning Balance | $250.00 | ||||

| 7/1 | Payday | $700.00 | $950.00 | ||

| 7/2 | Rent | $490.00 | $460.00 | ||

| 7/3 | Starbucks | $5.90 | $454.10 | ||

| 7/5 | Arco Gas | $35.13 | $418.97 | ||

| 7/5 | GMAC Finance | $221.25 | $197.72 | ||

| 7/5 | Geico | $65.36 | $132.36 |

Do not assume this is your final balance! The risk is what you spent and may not remember, so keep a good buffer for now. Since this is early in the process, you need to watch your account balance closely.

Typically, you should be able to reconcile your account on a weekly basis and feel confident about knowing it's correct, but the number of transactions that go through your account ultimately determine how often you need to reconcile.

So let's assume that it's a week later and a number of transactions have gone through your account. It's time to sit down and pull all of those receipts out and add them to the template. When you're done entering all of your receipts, you should have an accurate idea of how much money is in your account, but to know for sure, you need to "reconcile" it. That means you need to either get a bank statement or pull up the transactional record online. The timeliest method is to pull up the transaction record from your banks website. Once you pull up that detail, start comparing your transactions.

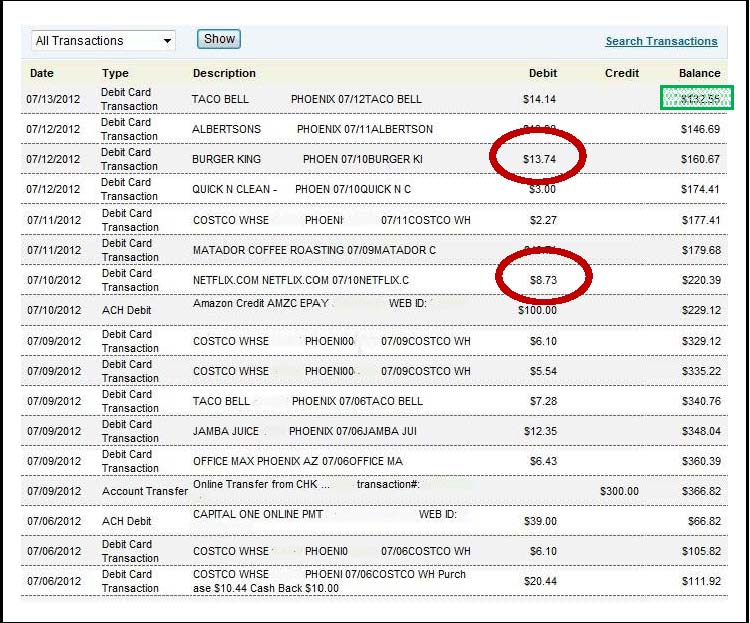

The example below shows what a typically screen from your bank might look like; you can either compare directly to your screen or print out the transactions and compare from the printed page.

Notice that the bank register on the right has the newest transactions at the top while our register starts at the top and has the newest transactions at the bottom; this is pretty typical. You can change it on your register, but it’s usually easier to adjust to it.

Your register Bank transaction report

| Date | Description | Deposit | Deduction | Clr | Balance |

|---|---|---|---|---|---|

| Beginning Balance | $250.00 | ||||

| 7/1 | Payday | $700.00 | x | $950.00 | |

| 7/2 | Rent | $490.00 | x | $460.00 | |

| 7/3 | Starbucks | $5.90 | x | $454.10 | |

| 7/5 | Arco Gas | $35.13 | x | $418.97 | |

| 7/5 | GMAC Finance | $221.25 | x | $197.72 | |

| 7/5 | Geico | $65.36 | x | $132.36 | |

| 7/6 | Costco | $20.44 | X | $111.92 | |

| 7/6 | Costco | $6.10 | X | $105.82 | |

| 7/6 | Capital One | $39.00 | X | $66.82 | |

| 7/9 | Deposit | $300.00 | X | $366.82 | |

| 7/9 | OfficeMax | $6.43 | X | $360.39 | |

| 7/9 | Jamba Juice | $12.35 | X | $348.04 | |

| 7/9 | Taco Bell | $7.28 | X | $340.76 | |

| 7/9 | Costco | $5.54 | X | $335.22 | |

| 7/9 | Costco | $6.10 | X | $329.12 | |

| 7/10 | Amazon Credit Card | $100.00 | X | $229.12 | |

| 7/11 | Matador Coffee | $40.71 | X | $188.41 | |

| 7/11 | Costco | $2.27 | X | $186.14 | |

| 7/11 | Joe Smith | 100.00 | 86.14 | ||

| 7/12 | Quick Clean | $3.00 | X | $83.14 | |

| 7/12 | Albertsons | $13.98 | X | $69.16 | |

| 7/12 | Taco Place | $14.14 | X | $55.02 |

In our example, we are printing out transactions since 7/06. Start with the earliest date and mark the "Clr" box in your template to indicate the transaction you recorded in your register has cleared the bank. If you see a transaction on your bank statement that isn't in your register, circle it or write it down to verify later. You will also want to validate that the amounts are the same on both lists. Once you get through both lists, notice the items on your register that are not checked. Compare those to the items you circled (or wrote down) from the bank statement; are any of them similar? You may have written down a different name than the official name the business uses. Make sure you understand why any remaining unchecked items in your register are still unchecked. If you have an item from Pizza Hut that is still outstanding, you need to find out why; a company that size would have processed the transaction immediately. Some smaller companies may post the next business day and some really small companies may post once per week. It may also be important to double check the receipt to see if you used a credit card instead of your debit card. Once you're confident of the remaining items on the register, it's time to add the circled (or noted) items from the bank statement and carry your total to get the updated balance. If you take that balance and add back any uncleared transactions, you will have the exact same balance as your bank. If you do not, double check your beginning balance and validate that all of the amounts on your register match what actually cleared the bank. It's easy to transpose a number or, while rare, it's possible a vendor charged you the wrong amount.

From the example, you can see that a check for $100 to Joe Smith isn’t on the bank statement and that two amounts from the bank statement are not on the register, Netflix for $8.73 and Burger King for $13.74. Add those items to your register:

| Date | Description | Deposit | Deduction | Clr | Balance |

|---|---|---|---|---|---|

| 7/12 | Quick Clean | $3.00 | X | $83.14 | |

| 7/12 | Albertsons | $13.98 | X | $69.16 | |

| 7/12 | Taco Place | $14.14 | X | $55.02 | |

| 7/10 | Netflix | $ 8.73 | x | $46.29 | |

| 7/13 | Burger King | $13.74 | x | $32.55 | |

Register Balance: $32.55 Add uncleared transactions:

Joe Smith +$100.00

Balance: $132.55

Notice that your calculated balance of $132.55 equals the balance at the top of the bank’s register of $132.55, that means you are balanced! Also notice that your actual balance is $32.55 because a check to Joe Smith hasn’t cleared yet! Don’t spend that money, it’ll clear when you least expect it. Plus, legally, once you spend it, whether it posts or not, you are required to have the money in your account to cover it, so don’t play the “float” with your account.

The real challenge is getting used to doing this each and every week. Most people start out with good intentions and then slowly stop keeping track. You can only avoid overdraft fees if you spend the time upfront to manage your bank account.

Summary:

- Create a list of all reoccurring deductions

- Save ALL of your receipts

- Record all of your transactions into a register

- Reconcile your register against a bank statement

- Repeat!